By David Colker - Los Angeles Times Staff Writer

September 16, 2008 -- See Sally. See Sally run from the bank. Run Sally run.

In the midst of one of the worst banking crises in decades, the U.S. Treasury Department today will launch a long-planned program to teach young Americans about credit and other financial matters.

The theme of the campaign: "Don't let your credit put you in a bad place."

Like in bankruptcy court?

Don Iannicola, the department's deputy assistant secretary for financial education, tried to put the best face on the timing of the announcement.

"The events unfolding in the last few months can be seen as a national teachable moment," Iannicola said.

Planning for the program, which cost about $750,000, began last year. Iannicola said Treasury officials didn't consider delaying the launch.

"There is no bad time for people to learn about their money and their credit," he said.

The Treasury folks aren't planning a similar program for the heads of financial institutions or government regulators.

Iannicola acknowledged that some might detect a contradiction in a Treasury-sponsored education program being launched at a time when slack government oversight was getting some of the blame for the mortgage market meltdown that begat the credit crunch that led to Monday's financial fallout.

"Education and regulation are not at odds with each other," he said.

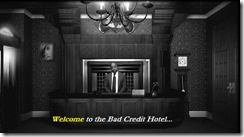

The program will consist of television and radio spots, Web banners and a site (www.controlyourcredit.gov)  that has an interactive game called "The Bad Credit Hotel."

that has an interactive game called "The Bad Credit Hotel."

No word on whether there will be a Lehman Bros. suite or early check-out policy.

September 16, 2008

HP-1140

Treasurer Anna Escobedo Cabral

Remarks at Launch of Multi-Media Campaign

to Help Young Adults Control Their Credit

Washington - Thank you, Dan. On behalf of Secretary Paulson, welcome to the Treasury Department. And welcome to the launch of our new multi-media campaign to help consumers understand more about their credit.

Credit can be a helpful tool for a healthy, prosperous financial existence. But all too often, many Americans fall prey to the pitfalls of not using credit wisely. This is especially true for young Americans who may have a less thorough understanding of credit and who tend to think less about the consequences of their financial decisions today.

In partnership with the Ad Council, Treasury has decided to take action. Today we launch a new campaign aimed at helping young adults think twice about their spending habits and how their behavior today can affect their credit history tomorrow.

The campaign, which targets 18-24 year-olds who are already in debt or about to get into unmanageable debt, will use Public Service Announcements to provoke a second thought or a pause when considering the true cost of a purchase. Our hope is that through this campaign, young adults will develop more thoughtful and conscientious spending habits.

As you will see, the PSAs end with the tagline "Don't let your credit put you in a bad place." And as we all know, poor credit history can do just that. It can cost you a job, car loan, apartment, or even cause public embarrassment.

The campaign includes new television spots, radio spots, web banners and a new web site. It also includes a radio spot in Spanish, and a Spanish-language version of the web site, which is very important.

These new PSAs from Treasury and the Ad Council will air in advertising time donated by the media.

In addition, the PSAs direct people to a new website: www.controlyourcredit.gov

On this new web site, visitors will find free financial information and tools, as well as play an interactive game, The Bad Credit Hotel, that explains the importance of having a good credit score.

I would like to thank Treasury's Office of Financial Education and its outreach team for working so diligently on this important campaign.

I would also like to say that we are pleased to partner with the Ad Council on this. Over the years, they have brought us Smokey the Bear, McGruff the Crime Dog, the Friends Don't Let Friends Drive Drunk campaign – just to name a few of their tremendously successful campaigns. And now, with the help of Lowe Worldwide, we hope that the Bad Credit Hotel will be included as another piece of their memorable collection.

●●smf 's 2¢: At the risk of misinterpreting kids (The DOT target of young people 18-24 is way late!) and proving myself to be the old fogy I suspect I am - this game is fun and educational! Teaching Financial Literacy - especially as it covers personal debt and credit - needs to be one of those 'standards' we are so preoccupied with: "College Prepared, Career Ready & Financially Aware"

Better youngsters learn it from this game and the creepy desk clerk - where one checks into the dreaded Room 205 at the Bad Credit Hotel and tries to upgrade to Suite 850, 205 and 850 being the nadir and summit of possible credit scores - than in the Real Game of Life where credit scores count more than the SAT, STAR or CAHSEE. ...or from the fiscal geniuses on Wall Street or in Sacramento.

If there is any hanky-panky in this backstreet hotel all the players must first take heed of Superintendent Brewer's father's advice: "There is no romance without finance."

No comments:

Post a Comment